Assessing the Fed’s Potential Rate Cut: An Opinion Editorial

The recent economic report and ensuing market chatter have set the stage for heated debates on whether the U.S. Federal Reserve should cut rates this September. With inflation data coming in cooler than expected for July, many believe that a rate cut is on the horizon. However, as we dig into the topic, it becomes clear that there are plenty of tricky parts, tangled issues, and complicated pieces to consider before drawing any definitive conclusions.

In this editorial, I intend to offer a balanced perspective on the economic pressures, the Fed’s decision-making process, and the broader implications of a September rate cut. While the market sentiment is overwhelmingly confident—pricing in a more than 96% chance of a rate reduction—the fine points of inflation data, employment statistics, and political pressures reveal a much more nuanced picture.

Understanding the Fed’s Upcoming Move

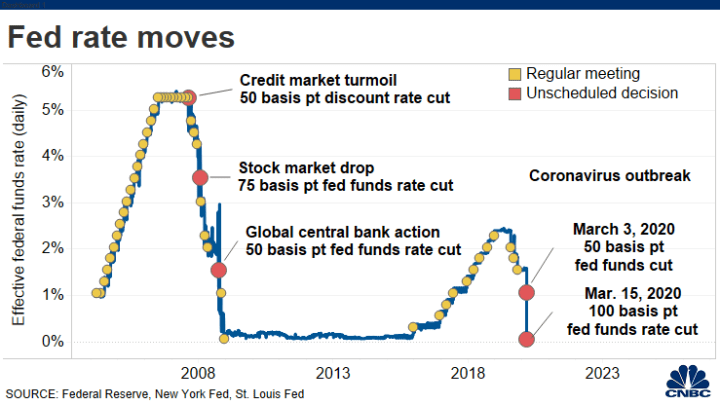

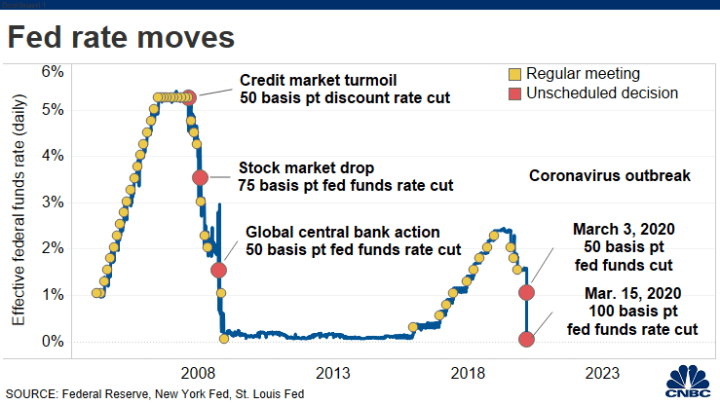

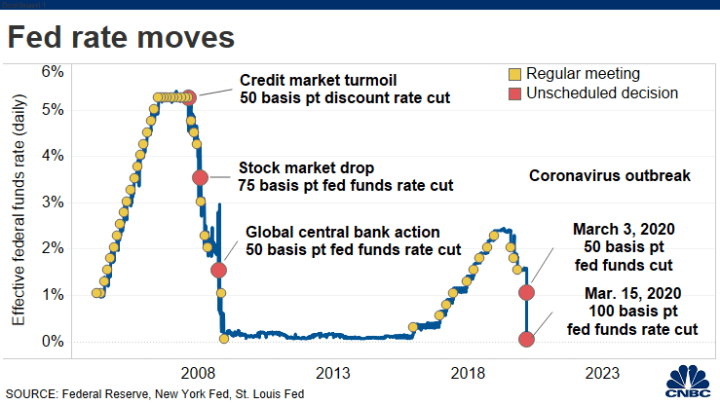

Market observers are buzzing about a September rate cut, a move that many analysts believe will provide needed relief to an economy facing slowdown concerns. The Federal Reserve’s role is not just about addressing headline inflation, but also about steering the economy through the twists and turns of volatile market conditions. Even as some officials argue that the current pause in tightening has been beneficial for economic activity, the debate over the size of the cut continues to be a subject loaded with tension.

Cooler Inflation and Its Implications

One of the main drivers behind the potential rate cut is a cooler-than-expected inflation reading for July. Investors and senior economists alike are taking notice, noting that headline inflation has come in at 2.7%—a figure that has fueled market optimism. However, when we take a closer look at core inflation, which clocks in at around 3.1%, the picture isn’t as rosy.

This distinction between headline and core inflation is critical. While the headline figure benefits from volatile items like food prices, the core reading excludes these items, offering a more stable yet arguably more concerning metric. The small twist in core inflation numbers highlights several subtle details that might make a near-term rate cut more intimidating for the Fed. Such details underline the importance of managing your way through not only the headline figures but also the little complexities that could influence monetary policy.

Labor Market Data and the Rate Cut Debate

Adding to the complexity is the mixed picture provided by labor market data. Recent job reports have shown payroll growth figures that fall short of expectations—a fact that was particularly notable in May and June when earlier tallies were dramatically revised downward. With the average gain over the past three months coming in at a mere 35,000 jobs rather than the forecasted 100,000, the labor market appears to be showing signs of strain.

These job market figures contribute to an overall narrative that the economy might be slowing down more than anticipated. In such an environment, some believe it would be prudent to take a more aggressive monetary easing approach by implementing a larger rate cut to offset earlier missed opportunities. Treasury Secretary Scott Bessent, for instance, has argued that a 50 basis-point reduction in September could help rectify the delayed reaction to underlying economic challenges.

Political and Market Pressures in Economic Decision-Making

It is clear that policy decisions at the Federal Reserve do not occur in an economic vacuum. Caught between competing pressures from the market and political voices, Fed officials are tasked with making a decision that is both timely and well-informed by data. Although the Fed repeatedly emphasizes that its decisions are guided solely by economic data and anecdotal evidence, influential figures such as Treasury Secretary Scott Bessent and even President Trump have openly expressed support for a larger rate cut.

Political Views Versus Economic Data

Political pressures can sometimes complicate the picture. While some officials and political leaders would like to see a swifter response—arguing that the Fed has been too slow in adjusting monetary policy—such views must be tempered with a careful examination of the actual economic data. For instance, the recent upward tick in core inflation and the below-forecast job gains both suggest the need for caution.

It is important to weigh these political views against the subtle details present in the economic numbers. A rate cut, especially one larger than 25 basis points, might send mixed signals if the data does not support such a move. Investors and analysts continue to debate whether a more aggressive rate cut is truly necessary or if a more measured approach is warranted over the coming months.

The Role of Market Sentiment

Market sentiment is a powerful force that influences expectations and can, in some cases, guide future economic policy. Tools such as futures contracts and expert surveys are being used by financial professionals to gauge the likelihood of a rate cut in September. The overwhelming consensus—mirrored by investor pricing indicating a 96% chance—may, however, oversimplify the reality behind monetary policy decisions.

One must remember that market sentiment, while influential, is only part of the equation. It is essential to get into the nitty-gritty details to see if the economic fundamentals justify a rate cut. The interplay between consumer spending, business investment, and inflation data shows that while a reduction in rates seems probable, the underlying economic conditions might call for a more conflicted approach.

Key Economic Indicators: A Closer Look at the Data

To understand the Fed’s decision, it is necessary to take a closer look at the data points that are being scrutinized by economists and policymakers alike. Below is a summary that highlights some of the fine points and tricky parts of the latest economic indicators.

| Indicator | Current Reading | Analyst Expectations | Implication |

|---|---|---|---|

| Headline Inflation | 2.7% | 2.7% or below | Supports easing of rates |

| Core Inflation | 3.1% | Near 2% target | Raises caution |

| Payroll Growth (Recent Months) | ~35,000 jobs average | ~100,000 jobs | Indicates a slowing labor market |

This table underscores the contrasting trends in headline versus core components of inflation. While the softer headline numbers foster optimism for a rate cut, the persistent core inflation and subdued job growth serve as cautionary signs. These small distinctions are critical for policymakers who must work through the subtle details to make an informed decision.

Weighing the Potential Benefits and Risks

An immediate rate cut can potentially stimulate economic activity by reducing borrowing costs, encouraging spending, and bolstering business investment. However, this approach is not without its pitfalls. When structuring policy, the Fed must consider both the benefits of supporting economic growth and the risks associated with accelerating inflation.

Benefits of a Rate Cut

A rate cut can be seen as a tool to invigorate an economy that might be facing a slowdown. When interest rates fall, consumers and businesses can borrow money more cheaply, which in turn can boost economic activity. Here are some of the key benefits to consider:

- Lower Borrowing Costs: Reduced rates make it less expensive to finance big-ticket home improvement projects, invest in energy-efficient upgrades, or even secure home security systems.

- Stimulated Consumer Spending: With mortgage rates and personal loan rates potentially lowered, households might feel more confident in taking out loans for remodeling projects or maintenance services.

- Boost for Small Businesses: Businesses involved in home construction, heating and cooling, and landscape maintenance could see increased demand for their services as financing becomes more accessible.

- Portfolio Diversification: Investors might seek yield in medium-duration quality bonds, considering a rate cut as an opportunity to secure better returns on their portfolio income amid falling cash interest rates.

These points illustrate how lower interest rates could, theoretically, spur activity across several sectors, including home improvement and services—a benefit not only confined to the financial markets but also visible in daily consumer spending.

Risks and Potential Pitfalls

On the flip side, there are several risks associated with a quick rate cut that should not be dismissed outright. The possibility of reigniting inflation, particularly when certain key economic indicators are still on the rise, is a significant concern. Here are some of the risks that might come into play:

- Reigniting Inflation: Lower rates can sometimes lead to an overheated economy, where increased spending pushes prices up further, especially if core inflation remains stubbornly high.

- Mixed Signals: A larger-than-expected cut might signal that the Fed is more desperate than it appears, which can create uncertainty among investors and home service providers alike.

- Future Rate Hikes: Once rates are lowered, the Fed might have less room to maneuver if inflation were to spike unexpectedly. This concern is particularly relevant to homeowners holding mortgages and businesses planning for long-term investments.

- Delayed Adjustments: If the rate cut is seen as an overreaction, it could delay the necessary adjustments in monetary policy when the economy starts to heat up again later in the year.

Given these competing benefits and risks, it is clear that any rate cut decision must be taken after carefully working through the tricky parts of the data and the broader economic landscape.

Impact on Home Improvement, Maintenance, and Security

Beyond the financial markets, the potential rate cut has tangible implications for homeowners and industry professionals in the home improvement and home services sector. Lower rates typically translate into lower borrowing costs for mortgages and home improvement loans—factors that many homeowners consider when planning their next big project.

Home Improvement Financing Benefits

For homeowners, the prospect of lower interest rates can be extremely appealing. Here are a few ways that a rate cut might indirectly benefit those looking to upgrade their living spaces:

- More Affordable Loans: Reduced interest rates mean that loans for remodeling or renovating a home become cheaper, which can encourage homeowners to invest in upgrades such as new roofing, energy-efficient windows, or security systems.

- Increased Home Value: Investments in home improvement not only add personal satisfaction and comfort but can also increase the market value of the property in a competitive housing market.

- Boost for Local Contractors: Home service professionals—from electricians and plumbers to landscapers and security installers—may experience increased demand as homeowners take advantage of favorable borrowing conditions.

Ultimately, the ripple effects of monetary policy changes extend well beyond Wall Street, touching the everyday lives of people who depend on affordable credit to maintain and improve their homes.

Challenges in the Home Services Market

While lower interest rates can provide opportunities, they also introduce certain challenges for professionals in the home services industry. For instance, the uncertainty around the timing and magnitude of rate cuts might lead to budgeting challenges and delayed project planning.

Home service providers and improvement contractors need to stay agile in the face of these often confusing bits from the broader economy. Here are some of the challenges they might face:

- Cash Flow Management: With potential volatility in the financial markets, managing cash flow becomes more nerve-racking. Contractors may need to re-assess their pricing models and credit terms to ensure stable operations.

- Project Scheduling: Homeowners could delay or accelerate projects based on expected financing conditions. Providers must figure a path through this uncertain landscape to maintain a steady workflow.

- Competition: As more businesses vie for a share of increased consumer spending, establishing a competitive edge in pricing and service quality is super important. Staying informed about wider economic trends can help professionals adapt their strategies.

These points not only highlight the tangible effects of monetary policy on the housing market but also underscore the interconnectedness of economic decisions and everyday financial planning, from home repairs to security system upgrades.

Mixed Signals and the Federal Reserve’s Tightrope Act

The Federal Reserve is tasked with the challenging responsibility of balancing multiple, often conflicting, indicators when setting policy. With the current economic environment, the Fed is trying to find its way through a landscape filled with subtle details and conflicting signals. Even as market sentiment leans towards an imminent rate cut, the mixed signals from payroll data and persistent core inflation continue to complicate the picture.

Balancing Act: Stimulating Growth Without Overheating the Economy

The Fed’s decision-making process is similar to finding your way through a maze of small distinctions and hidden complexities. On one hand, a timely rate cut can provide a much-needed boost to a slowing economy. On the other, premature easing could fuel further inflation, undermining the long-term stability of financial systems.

Key points in this balancing act include:

- Offering consumers and businesses lower borrowing costs to stimulate growth.

- Maintaining confidence by ensuring that inflation remains in check.

- Understanding that subtle details—such as slight differences between various inflation measures—can have outsized effects on the overall economic outlook.

In tackling these challenges, the Fed must work through every twist and turn of the available economic data to make decisions that support both short-term recovery and long-term prosperity.

Perspectives From Industry Experts

Several industry experts and economists have weighed in on the upcoming monetary policy decision. While some, like UBS Global Wealth Management’s Chief Investment Officer, maintain that a gradual series of rate cuts is the key to supporting economic growth, others express concern that the recent data may force the Fed to adopt a more cautious approach.

Here are some views from the field:

- UBS Global Wealth Management: “With overall inflation under control amid a slowing economy, we foresee the Fed reversing its tightening policy starting in September with a series of moderate cuts. This provides key relief for both investors and homeowners alike.”

- Deutsche Bank Analysts: “Even though market pricing appears confident about a September rate cut, upcoming labor market data might compel the Fed to delay further easing. It’s a delicate balance that requires careful steering through the challenging bits of economic data.”

- J.P. Morgan Wealth Management: “The data on core inflation and persistent job growth shortfalls remind us that a full-blown rate cut, as welcomed by market sentiment, is not as much a sure thing as it appears on the surface.”

These varied perspectives reflect the layered nature of today’s economic landscape and underscore the need to consider every fine shade when making predictions.

Looking Ahead: The Road to Future Monetary Policy

The upcoming September meeting and later sessions are expected to provide additional clarity on the future path of U.S. monetary policy. With the Fed missing a meeting this month in favor of focusing on the Jackson Hole Economic Policy Symposium, policymakers and market participants will have additional time to gather essential data and make informed decisions.

Data-Driven Future Decisions

In the coming months, several key data releases—from employment figures to updated inflation statistics—will play a critical role in shaping the Fed’s policy course. Rather than viewing a September rate cut as a foregone conclusion, it may be more prudent to see it as part of a longer journey toward recalibrating the nation’s monetary stance.

Some of the key indicators to watch include:

- Employment Figures: Updated jobs data will reveal whether the labor market continues to show signs of instability or improvement.

- Consumer Price Index (CPI) Trends: Trends in both headline and core inflation will be scrutinized to determine if price pressures are evolving as expected.

- Business Investment and Consumer Spending: Broader economic activity figures will help contextualize the effectiveness of any rate adjustments made by the Fed.

By keeping a close eye on these metrics, it becomes possible to manage your way through the maze of economic decisions, understanding not only the current state of affairs but also the long-term trajectory of monetary policy.

Managing Uncertainty in a Changing Economic Climate

The current economic landscape is, by many measures, tense and full of problems. Given the uncertainty that surrounds the potential rate cut—and the possibility of further adjustments down the road—both investors and homeowners would do well to prepare for a period of transition. Here are some steps to consider during this period of change:

- Stay Informed: Follow reputable sources and expert analyses to understand the subtle details of each economic release. Timely information can help you figure a path through the shifts in market sentiment and policy adjustments.

- Review Financial Plans: Whether you’re considering a home improvement project or planning a financial investment, review your approach in the context of potential changes in borrowing costs.

- Diversify Investments: In times of uncertainty, diversification—and a focus on quality assets—can provide a buffer against sudden market changes.

- Monitor Home Service Costs: For homeowners, tracking interest rate changes can help ensure that rates on mortgages and personal loans remain affordable, making it easier to finance major projects such as remodeling or installing home security systems.

Adopting a proactive stance by preparing for multiple scenarios can ease some of the nerve-racking aspects of this economic transition. By understanding the fine points behind the rate cut debate, you can better position yourself to take advantage of favorable conditions while mitigating potential risks.

Conclusion: Balancing Act for the Fed and the Homeowner

The discussion surrounding a September rate cut encapsulates the broader challenge faced by policymakers today: how to support economic growth without inadvertently stoking inflation. For homeowners and industry professionals in the home improvement and home services arena, this decision carries far-reaching implications. Whether financing a new roof, upgrading heating and cooling systems, or investing in enhanced home security, the cost and availability of credit play an essential role in shaping outcomes across the board.

As we take a closer look at the present economic data, it becomes evident that the Fed is working through multiple layers of feedback—tackling the intricate twists and turns of headline versus core inflation, mixed labor market signals, and political pressures. While the prevailing market sentiment might paint a picture of a simple, straightforward decision to cut rates, the reality is loaded with subtle details and challenging decisions that must be considered.

At its core, the debate is about more than just managing interest rates—it reflects a broader commitment to ensuring long-term economic stability. For homeowners, this means that while lower rates could make it easier to finance renovations and home upgrades, caution is advised when interpreting the indicators that guide these decisions. In today’s environment, where even small differences in data points can lead to differing policy responses, the path ahead remains both promising and perilous.

As we look forward, the key will be to observe how upcoming data, especially regarding the labor market and core inflation, influences the Fed’s next move. Investors, homeowners, and industry professionals alike should be ready to adapt as new information becomes available and as the Federal Reserve continues to fine-tune its policy measures in response to a shifting economic landscape.

In conclusion, while a September rate cut appears likely based on current market signals, it is by no means a done deal. The decision remains a balancing act—a careful, data-driven process that must weigh the benefits of stimulating growth against the risks of reigniting inflation and destabilizing the economic recovery. For those in the home improvement and home services sectors, staying informed and flexible will be essential in making the most of any changes that come down the road.

Ultimately, understanding the Fed’s next move requires not only an analysis of the headline numbers but also a deep dive into the subtle, complicated pieces hidden beneath the surface. As we figure a path through this economic maze, let us remain vigilant, prepared, and committed to a balanced approach that safeguards both immediate interests and long-term prosperity.

Originally Post From https://fortune.com/2025/08/13/markets-september-rate-cut-bessent-50-bps-call/

Read more about this topic at

Dollar slips further as anticipation mounts of Fed interest …

Dollar extends weakness as anticipation mounts of Fed …