Reassessing the U.S. Housing Landscape: A Post-Pandemic Perspective

The U.S. housing market is often seen as the world’s most valuable savings account—a repository of combined wealth that spans from local tradespeople to top executives. For many, the dramatic evolution of home values, particularly as the combined market value has surged past $55 trillion, is a striking narrative of economic promise and worry. Over the past few years, shifts in affordability, inventory levels, and regional trends have rewritten the story of housing wealth. This editorial offers a closer look into these changes while poking around at the subtle bits that have redefined housing markets across the country.

Understanding the Current Housing Wealth Map

Historically, one-third of the U.S. housing market’s impressive $55 trillion value was attributed to nine major metro areas, with individual values exceeding the trillion-dollar mark. However, these tremendous figures have begun to tilt as affordability challenges and inventory gains alter the traditional hierarchy of housing wealth. What once appeared to be fixed and predictable has now become a rapidly shifting mosaic, full of problems and off-putting twists and turns that demand serious attention.

How the Pandemic Sparked Shifts in Housing Dynamics

The COVID-19 pandemic was not just a global health crisis—it was a catalyst that reshaped the housing market in unexpected ways. During the pandemic, buyers and sellers alike were forced to reconsider what they need from their homes. With the rapid adoption of remote work and an increased desire for more space, many began to figure a path toward suburban and less-crowded areas. This shift led to unpredictable market dynamics in large metro areas that had long held sway over home values.

According to research published by Zillow, the post-pandemic era now sees smaller markets capturing significant gains, even as the largest metro areas across nine of the ten biggest markets suffer net losses in home values. These changes reveal that the landscape is far more fluid and sensitive to local economic conditions than it used to be.

Inventory Gains and Affordability: A Mixed Bag

One of the trickiest parts of today’s housing market is balancing availability with affordability. Although the total housing value shows upward momentum, affordability remains a considerable concern for both buyers and local economies. As inventory levels slowly back up to a balance that Realtor.com describes as “a rare state of balance,” the overall market feels the effects of both increased supply and daunting price pressures.

Rising Inventory Levels: Changing the Seller-Buyer Balance

For years, low inventory levels created a seller’s market in which prices soared and buyers battled for a limited number of homes. Recently, however, market trends have started to favor buyers in many regions. In fact, the availability of a five-month supply of homes—something not seen during previous summer seasons—signals a significant shift. Typically, a supply of less than four months indicates a seller-dominated market, while more than six months suggests ample room for buyers. The current position, which sits in between these extremes, has led to a nuanced market dynamic where both buyers and sellers face compelling challenges.

- For buyers, increased inventory means more options and potentially more negotiating room on price.

- For sellers, the softening market conditions require realistic expectations on pricing and sales timelines.

- For investors, these conditions present both opportunities and uncertainties as the market attempts to regain its previous momentum.

This balance has created an environment where every stakeholder must work through complicated pieces while carefully considering their next move.

Regional Differences: Where Wealth Shifts and New Construction Plays a Role

While it is tempting to paint the housing market with one broad brush, the reality is that local conditions vary wildly from one region to another. Nowhere is this more evident than in the contrast between the longstanding powerhouses of California, Texas, and Florida, and the newly emerging markets in the Northeast and Midwest.

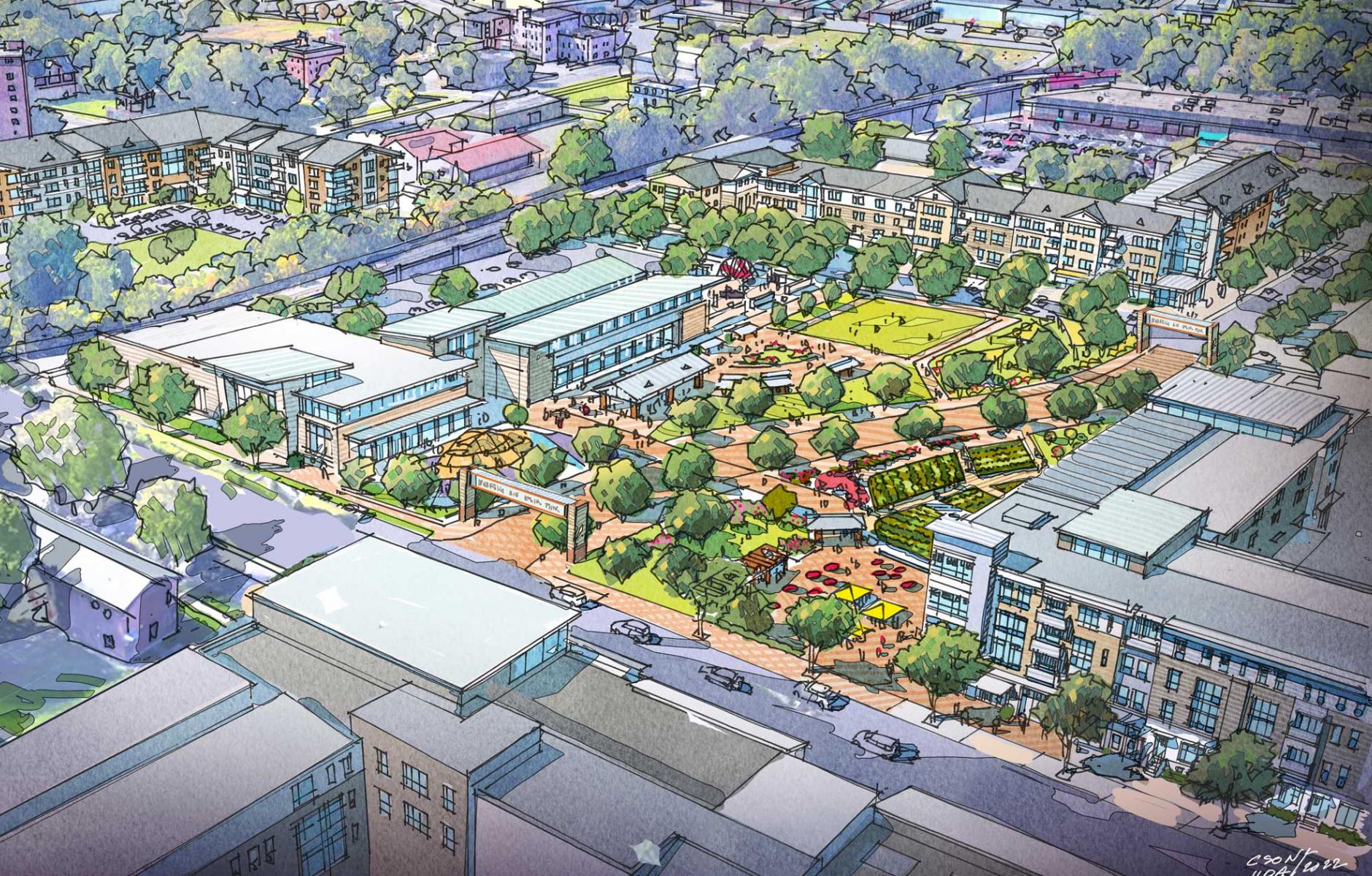

Suburban Revival and the Rise of New Construction

New construction has emerged as a key contributor to housing value, particularly in regions that are quickly becoming hotspots for growth. According to Zillow, newly built homes have added around $2.5 trillion to the national housing value since early 2020, contributing roughly 12.5% of total gains. States like Utah, Texas, Idaho, and Florida are at the forefront, with significant new construction investments leading the charge. This surge in new builds is proving essential for addressing inventory shortages and meeting the new demands of a post-pandemic buyer base.

Developers and local governments alike have recognized the need to build more than just traditional housing – they are now creating communities that balance convenience, affordability, and modern amenities. This has prompted an increased focus on:

- Smart community planning with integrated outdoor spaces and energy-efficient designs

- Innovative construction methods that reduce build times and cost

- Mixed-use developments that integrate residential and commercial properties

These developments are not only transforming skylines but are also causing subtle shifts in where future wealth is likely to accumulate in the housing market.

Investor Activity Versus Owner-Occupied Demand

The trends of today’s market are also influenced by the contrasting strategies of investor buyers and those looking for a primary residence. In periods when affordability pressures are high, and prices have even begun to dip, investors become increasingly active. Data from real estate analytics firm Cotality suggest that in recent quarters, nearly 30% of home sales have gone to investors. This increased activity among investors is a response to the appealing pricing adjustments and a slowdown in demand from owner-occupiers, who are finding it challenging to compete.

Understanding Investor Activity in a Shifting Market

Investor participation can often inject both vitality and tension into a housing market. On one hand, investors help sustain market activity when traditional buyer demand slackens. On the other, their presence can drive up prices if conditions change too rapidly. Some of the notable points include:

- Investors bring capital that can stimulate local economies and sometimes catalyze neighborhood renewals.

- Their purchase patterns may lead to quicker turnovers, impacting long-term residential stability.

- A shift back toward owner-occupied demand could quickly reverse the favorable conditions for such investors.

As mortgage rates fluctuate and refinancing opportunities appear, the balance between investor enthusiasm and owner-driven purchasing stands as one of the key little twists in understanding the market’s future direction.

Analyzing the Data: A Closer Look at Statistical Insights

1. In June alone, Zillow reported that 26.6% of for-sale listings cut their prices—the highest drop for that month since 2018.

2. COVID-era “boomtowns” like Raleigh, Nashville, and Phoenix saw the most significant price cuts, reflecting broader trends in affordability due to increased local inventory levels.

Understanding these data points is essential because they offer a snapshot of the delicate balance between supply and demand in today’s housing market. When more homes are available and prices dip, it suggests that the market is recalibrating from its pandemic-fueled highs to a new normal. It is a reminder that each shift comes with its own set of confusing bits that require stakeholders to get into the data to truly understand the hidden complexities.

Regional Shifts in Home Price Gains and Losses

The traditional strongholds of housing wealth, notably California, Texas, and Florida, now face diminishing returns. Over the last year, these states have collectively shed significant housing wealth. For example, California lost about $106 billion, Texas approximately $109 billion, and Florida around $32 billion in home value. By contrast, the Northeast and Midwest have been catching up, with areas like New York and New Jersey recording robust gains in housing wealth. New York alone saw an increase of $216 billion, showcasing a distinct regional divergence that is altering long-standing trends.

Breaking Down the Regional Wealth Shifts

Examining these trends more closely reveals several important points:

| Region | Wealth Change | Main Factors |

|---|---|---|

| Northeast | Significant gains | High demand, limited inventory, robust local economies |

| Midwest | Steady gains | Increased new construction, shifting investor interest |

| Sun Belt (Florida, Texas, California) | Losses in some markets | Softening prices, rising insurance costs, affordability hurdles |

This regionally customized view helps illuminate why one cannot simply state that the overall market is either bullish or bearish. Subtleties abound, and every area has a different mix of benefits and challenges to work through.

Mortgage Rate Fluctuations and Their Impact on the Market

Mortgage rates significantly influence buyer behavior, and future predictions suggest that even a small change could spur a notable shift. Recent projections from Cotality indicate that the national home price growth rate could accelerate notably if mortgage rates see even a modest improvement. Although home prices have thus far shown only a slight year-over-year growth, the coming months might see a more pronounced shift as competitive dynamics between investor buyers and owner-occupiers intensify.

How Mortgage Rates Affect Homebuyers and Investors

For many, obtaining a mortgage is a nerve-racking process, especially when rates are fluctuating unpredictably. Here are several ways in which mortgage rate changes impact the market:

- Lower mortgage rates typically boost owner-occupied purchase demands, thereby pushing home prices upward due to increased competition.

- Higher mortgage rates tend to encourage investors to negotiate different purchase terms, given that lower competition from primary homebuyers might lead to better deals.

- Shifts in mortgage rate trends signal potential changes in overall market sentiment, influencing both listing values and regional inventory strategies.

Whether you’re a first-time homebuyer or a seasoned investor, keeping an eye on mortgage trends is key to figuring a path through today’s unpredictable market conditions.

The Role of Local Conditions in Creating a Balanced Market

Local economic conditions hold a super important place in determining the overall balance between supply and demand. As seen from recent Realtor.com data, active listings have begun to decelerate, while the market’s overall structure increasingly favors certain buyer segments. A deeper look at local factors is necessary to understand how inventory adjustments, pricing strategies, and even seasonal trends all coalesce into a somewhat harmonious yet tricky ecosystem.

Key Local Factors That Influence Housing Market Dynamics

Local conditions are influenced by a number of smaller, but essential, details. Some of these include:

- Employment Trends: Areas with expanding job markets tend to experience higher housing demand, which in turn affects how long homes stay on the market.

- Construction Activity: Regions with active new construction imply a bump in housing inventory, which can alleviate some pricing pressures.

- Local Regulations and Zoning: Changes in local policy, such as eased zoning requirements or incentives for development, can lead to significant fluctuations in available housing supply.

- Demographic Shifts: As populations migrate—from cities to suburbs or vice versa—the delicate balance of supply and demand shifts accordingly.

This mix of factors means that each market is navigating its own set of complicated pieces, and understanding these fine points is critical for anyone trying to get around the current economic climate.

Tackling the Inventory Challenge: New Construction and Market Equilibrium

The evolution of housing inventory is a central theme in today’s market. With the post-pandemic surge in new constructions, the availability of homes for sale is slowly creeping toward more balanced levels. This trend carries both promise and pitfalls. Developers are not only meeting new demands but are also striving to integrate modern considerations such as energy efficiency and smart home technology to make their projects more appealing.

Benefits of New Construction in Today’s Housing Market

New construction is providing several key benefits for the overall market, including:

- Increased Supply: More homes on the market reduce pressure on existing inventory and help moderate soaring prices.

- Modern Amenities: New builds often come equipped with energy-saving features, modern safety measures, and smart home technology that appeal to future-forward buyers.

- Boost to Local Economies: Construction projects generate jobs and circulate money within local communities, further supporting regional growth.

- Encouraging Buyer Confidence: Fresh constructions serve as tangible symbols of a revitalized market, offering hope to those who have been priced out of traditional, older neighborhoods.

Even though new construction helps ease some of the inventory issues, it also introduces its own set of challenges. Maintaining quality, managing costs, and ensuring that developments integrate well with existing community infrastructures are all nerve-wracking aspects that developers and local governments must address as they build the future of American housing.

Economic and Social Implications of Shifting Housing Wealth

The redistribution of housing wealth has broad implications that extend beyond the realm of home buying and selling. This evolution affects local communities, regional economies, and even national fiscal policies. As large metro areas witness a relative downturn in housing wealth, while the Northeast and Midwest experience gains, things could get more tense at both local and national levels.

How Shifts in Housing Wealth Affect Broader Communities

Here are some of the ways these market changes might ripple across broader communities:

- Wealth Distribution and Economic Mobility: Shifting home values mean that long-accepted centers of wealth might be experiencing declines, while regions previously considered secondary now have increasing influence. This could alter patterns of economic opportunity and mobility across the country.

- Local Tax Bases: Areas with declining home values might find themselves with reduced tax revenues, which can affect public services, school funding, and community projects.

- Community Identity: Rapid changes in home values can impact neighborhood demographics, potentially leading to shifts in cultural and social dynamics. Established communities may feel the pressure as newcomers and investors reshape local norms.

- Political and Fiscal Policies: The fluctuating housing market often prompts regulatory and policy responses at both local and federal levels. How authorities react to these changes can significantly influence the opportunities for future growth and stabilization.

It is important, therefore, for policymakers and community leaders to carefully sift through these subtle details when drafting economic strategies. Whether it’s addressing affordable housing shortages or investing in infrastructure, the intricate balance of local and regional factors plays a super important role in steering the market’s future.

Future Outlook: What Lies Ahead for the Housing Market?

While current trends present a picture of several moving parts and shifting dynamics, the future of the U.S. housing market remains as compelling as it is unpredictable. Continued shifts in mortgage rates, evolving patterns of investor activity, and dynamic local conditions all suggest that the market is on the cusp of further significant changes. Many experts foresee that a modest rebound in mortgage rates could trigger renewed interest from owner-occupiers, thereby applying upward pressure on home prices in select regions.

Key Factors to Watch in the Coming Years

Looking forward, several elements stand out as critical for shaping the market’s evolution:

- Mortgage Rate Trends: Any notable shifts in mortgage rates will play a key role in determining buyer behavior and overall market stability. Even slight improvements might lead to a surge in owner-occupancy, especially in regions that are currently dominated by investors.

- Regional Economic Recovery: As local economies continue to recover from the pandemic, the subsequent impact on housing demand and supply will vary considerably by area. Watch for regions that are new hotspots for tech, healthcare, or manufacturing growth.

- New Construction and Innovation: The pace of new development and modern construction practices will be critical. Areas that manage to effectively integrate innovative construction while maintaining community cohesion may see the most stable price gains.

- Policy and Regulatory Changes: Government measures—ranging from zoning adjustments to fiscal policies—will have ongoing effects on both the availability and affordability of housing. Stakeholders should remain vigilant about the regulatory landscape as it evolves.

Ultimately, it is clear that the market’s complex interplay of factors requires those involved to get into the nitty-gritty of local trends while keeping an eye on broader national statistics. Whether you are a homeowner, buyer, investor, or simply an observer, the evolving housing wealth map is a story of both opportunity and risk that merits careful, ongoing attention.

Balancing Homebuyer Confidence with Investor Caution

The current state of the market presents a paradox where both buyer confidence and investor caution coexist. Homebuyers are encouraged by the increase in inventory and the potential for better pricing, while investors are drawn by the prospect of acquiring properties at a relative discount. However, the present atmosphere is loaded with issues, requiring both groups to dig into the data and stay alert to market signals.

Strategies for Homebuyers in an Evolving Market

If you are in the market for a new home, consider these strategies to help steer through the current market challenges:

- Do your research: Stay updated with local market reports and mortgage rate trends to better understand when to buy.

- Consult local experts: Real estate agents and financial advisors offer valuable insights into the current regional market dynamics.

- Prepare for negotiation: With the recent trend of price cuts, understanding how much flexibility exists in pricing can make a significant difference.

- Think long-term: While short-term fluctuations can be nerve-racking, focus on the long-term potential of the property and neighborhood.

Being prepared with these strategies can help every prospective buyer find their way through the overwhelming twists and turns of an ever-changing housing market.

What Investors Should Consider in Current Conditions

For investors, the key is balancing the risks with opportunities that come from the current market’s subtle details. Here are some considerations:

- Market Timing: Monitor mortgage rate trends and local economic indicators closely to time your entry and exit in target markets.

- Diversification: Consider spreading investments across different regions to hedge against localized downturns.

- Property Condition: Focus on properties with potential for value improvement either through renovation or favorable neighborhood changes.

- Regulatory Impact: Remain aware of any policy changes that could affect property taxes, zoning laws, or rental regulations.

Investors who manage to work through the confusing bits and figure a path based on well-researched data are likelier to see benefits—even in a market that is arguing between investor excitement and homebuyer resurgence.

Concluding Thoughts: Embracing the Era of Change

The U.S. housing market, once viewed as a symbol of stable, long-term wealth, now presents an evolving tapestry fraught with shifting dynamics, regional disparities, and unpredictable economic forces. As inventory gains and affordability challenges continue to redefine market boundaries, every sector of the economy—from local communities to national investors—must remain alert to the subtle parts and fine shades that mark these transitions.

This transformation, spurred by the events of the past few years, is both promising and intimidating. Homebuyers can take some comfort in the increased opportunities provided by a more balanced market, while investors may find that their ability to pocket bargains from an oversupplied market creates new paths for growth. Regardless of one’s position in the market, the underlying lesson is clear: adapting to these changes requires a willingness to dive in, get into the nitty-gritty details, and stay informed.

As the market continues to evolve, one thing is evident—understanding local economic conditions, evaluating data trends, and preparing for both highs and lows have become super important strategies in the quest for housing stability. In this era of change, those who successfully work through the tangled issues and figure a path based on diligent research will be best positioned to thrive in the new reality of the U.S. housing landscape.

In conclusion, the post-pandemic transformation of the housing market is not just a temporary fluctuation but a significant shift that demands careful consideration by every stakeholder. Whether it’s through innovative new construction or strategic investor activity, the market is signaling profound change. This is a time for comprehensive, thoughtful analysis and proactive planning—an invitation to all who are invested in the future of American homes to embrace both the opportunities and the challenges that lie ahead.

Originally Post From https://www.scotsmanguide.com/news/nine-cities-hold-one-third-of-55-trillion-us-housing-value/

Read more about this topic at

How to Landscape Front Yards and Entryways to Maximize …

Landscape Layering: How to Create an Amazing …