News Corp’s Q3 Performance: A Closer Look at Digital Growth and Real Estate Recovery

News Corp’s third-quarter performance in CY2025 has sparked an engaging debate among observers and investors alike, highlighting a period where traditional media met digital innovation. With revenue climbing 2.3% year on year to an impressive $2.14 billion and earnings per share (EPS) exceeding analyst estimates, the company is staking its claim in a space that’s full of tricky parts and hidden complexities. In this opinion editorial, we take a closer look at how News Corp’s strategic pivot towards digital subscriptions, its repositioning in the real estate market, and the challenges of its book publishing division are shaping its future, while also noting some nerve-racking market trends.

At first glance, the recent quarterly results may appear straightforward – a modest increase in revenue paired with a profitable beat on earnings. Yet, a deeper examination reveals several subtle details and tangled issues that merit discussion. This op-ed aims to dive into the fine points of the company’s performance, scrutinize the reasons behind its results, and ponder on its strategies moving forward.

Digital Transformation Driving Media Industry Success

One of the most unmistakable signals coming from the Q3 report is the powerful impact of digital subscriptions and data analytics on News Corp’s business strategy. With platforms such as The Wall Street Journal and new digital products continuing to drive recurring revenue, the company is slowly moving away from traditional media models. This shift towards high-margin digital offerings is not just key – it’s super important for the future of media companies in today’s technology-driven landscape.

Digital Subscription Expansion and AI-Powered Innovations

The digital side of the business has been making headlines due to its consistent growth. Digital subscriptions now contribute significantly to the revenue mix, a trend that aligns with modern consumer behavior favouring online platforms and personalized content. The management has highlighted improvements in the Dow Jones segment, where digital revenue now accounts for a staggering 84% of the segment’s overall earnings.

Moreover, the introduction of GenAI-powered search capabilities in Factiva stands as a testament to the company’s efforts to stay ahead of the curve. By integrating AI into its suite of digital products, News Corp is not merely riding the wave of technological innovation – it is redefining the way data is consumed and used by its customers. These new features are gradually taking shape, with early traction pointing towards a future where artificial intelligence plays a central role in content analytics and subscription offerings.

Key Metrics in Digital Growth

The following table encapsulates some essential financial metrics from Q3 that illustrate the performance of the digital segment:

| Financial Metric | Reported Value | Analyst Estimates | Performance |

|---|---|---|---|

| Revenue | $2.14 billion | $2.10 billion | 2.3% year-on-year growth; 2% beat |

| EPS (GAAP) | $0.20 | $0.18 | 8.1% beat |

| Adjusted EBITDA | $340 million | $331.6 million | 2.5% beat with a 15.9% margin |

| Operating Margin | 10.4% | In line with last year | N/A |

These pointers indicate that while the numbers may be modest at first glance, they carry hidden stories of innovation and strategic alignment with a tech-savvy audience. It’s an expansion that brings both promise and its own set of complicated pieces to manage.

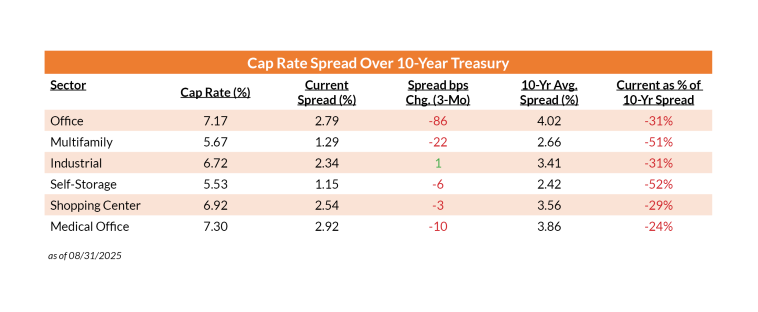

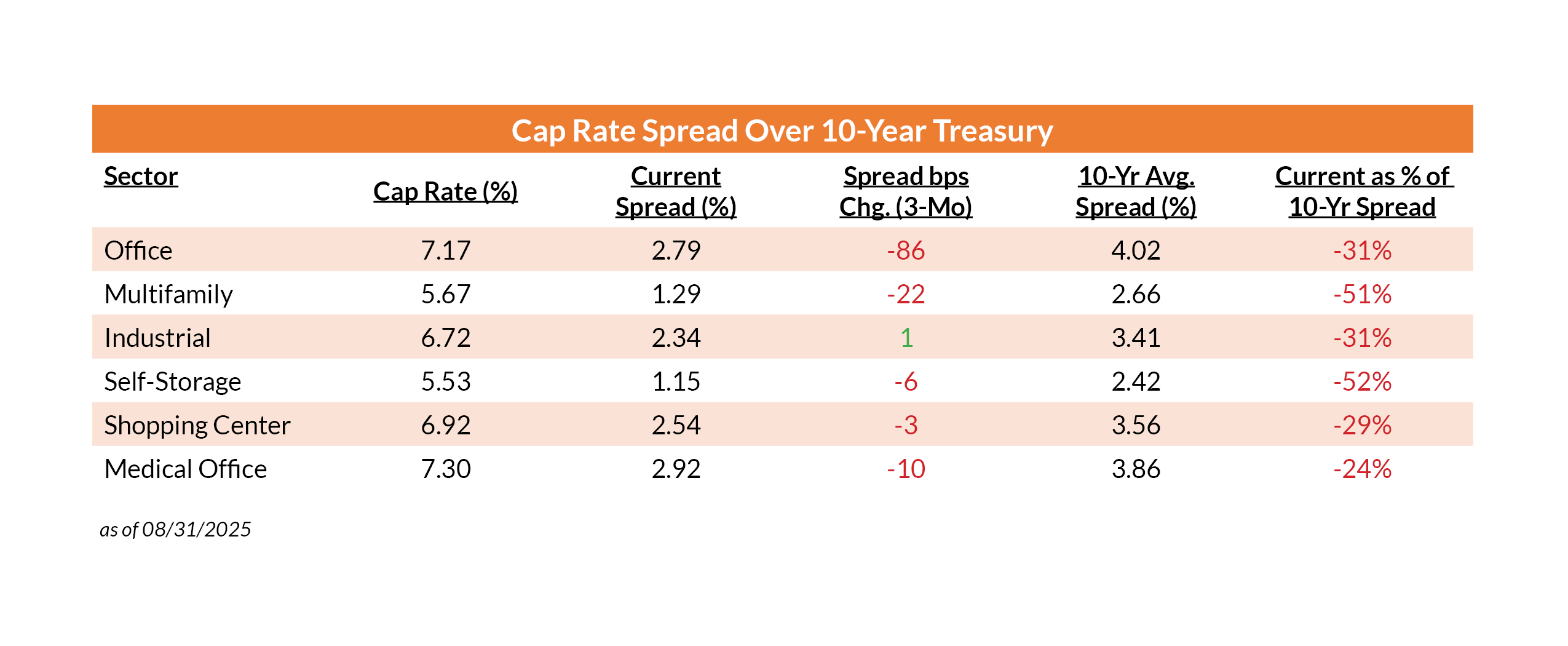

Real Estate Recovery: Trends in Digital Real Estate Services

Arguably one of the most interesting developments in the Q3 results is the revival in real estate activity, particularly evidenced through the performance of platforms like realtor.com. In a market that has been on edge for months, News Corp’s focus on digital real estate services appears to be yielding positive results. With revenue in this segment growing 9% year over year, the company is beginning to see the benefits of targeted investments aimed at enhancing user experience and product quality.

Driving Factors Behind U.S. Housing Market Recovery

While the housing market remains under certain pressures, several factors point to increased resilience. Improved engagement metrics and contributions from new homes and rental listings have played a role in pushing growth beyond expectations. In particular, the following influences have been highlighted by management:

- Enhanced user experiences through technology-driven interfaces.

- Premium offering investments to attract quality listings.

- Increasing trends of low mortgage rates, which bolster buyer sentiment.

- Consistent focus on digital real estate products in both the U.S. and Australia.

These elements collectively contribute to a landscape that, while complex in its twists and turns, offers a plausible path for continued growth and resilience. By aligning digital strategies with real estate recovery, News Corp is positioning itself to benefit from macro-level market trends that could propel the sector into a new era of profitability.

Market Reaction and Investor Sentiments

The market’s reception of these efforts has been mixed yet generally optimistic. The gradual recovery in U.S. and Australian property markets has been a double-edged sword; on one side, it provides renewed hope for a previously sluggish sector, while on the other, it remains vulnerable to economic headwinds and unpredictable interest rate movements. For investors and industry watchers, these are a series of fine shades and little twists that require careful monitoring.

Tackling the Book Publishing Conundrum

While the strides made in digital subscriptions and real estate recovery are commendable, News Corp’s traditional book publishing division has faced a set of tricky parts and nerve-racking challenges this quarter. The division was notably impacted by a $13 million write-off due to a distributor closure – a setback that points to the ongoing issues in a sector that is already full of problems.

Challenges and Potential Recovery in Publishing

Book publishing has historically been a cornerstone for media companies, though its relevance has been waning under the weight of digital competition. In the case of News Corp, the division is navigating through confusing bits and tangled issues that were once regarded as reliable revenue sources. Lower order volumes, compounded by unforeseen distributor closures, have forced the company to reconsider its parameters for success in this area.

Despite these obstacles, there are early signs of recovery that provide a glimmer of hope. Management has noted an uptick in order trends and the emergence of several bestsellers that might hint at a rebound. However, the path forward is likely to be filled with complicated pieces that require careful adjustments. The division’s trajectory is dicey, and while new opportunities may emerge, Book Publishing remains a segment where fine points and stubborn traditional practices may slow down rapid transformations.

List of Factors Influencing the Publishing Outlook

- Lower order volumes and reduced print distribution have created short-term revenue challenges.

- Distributor shutdowns have imposed unexpected financial strains.

- Emerging bestsellers denote a potential market revival, albeit one that is still tentative.

- Digital competition continues to erode traditional market share.

- Cost efficiency initiatives could help stabilize margins over time.

Given this mix of optimistic and worrisome signs, the book publishing segment serves as a reminder that even for large media houses, not every division will experience the same level of digital momentum. The intricate challenges here are a stark contrast to the robust performance seen elsewhere within the organization.

Cost Discipline, Capital Returns, and Corporate Strategy

In an era where every twist and turn in the market can have wide-reaching effects, cost discipline and effective capital allocation become crucial. News Corp’s management has been quick to point out that disciplined spending – especially in news media – is one of the pillars that has helped elevate margins and buffer any shocks from underperforming areas, such as Book Publishing.

Efficiency Measures and Share Buyback Programs

One of the standout points in the recent report is the company’s vigorous share-buyback program. Repurchasing stocks at a pace more than four times higher than previous quarters, News Corp is making a clear statement about its financial health and confidence in future performance. With a robust cash position and a concerted belief that the company is undervalued, this move not only serves to boost market sentiment but also helps solidify investor confidence during times of market unpredictability.

Additionally, cost efficiencies in regions like the U.K. and Australia have led to a rise in news media margins – from 3.3% to 5.5%. Digital advertising gains at flagship brands such as the New York Post further underscore the positive impact of internal optimizations. These measures, although they might appear to be mere balancing acts on paper, are essential steps in managing your way through market uncertainties.

Highlights of Cost and Capital Strategies

- Accelerated share-buyback programs to leverage a strong cash position.

- Operational cost controls in key markets such as the U.K. and Australia.

- Increased digital advertising revenue streams providing margin support.

- Portfolio optimization through strategic divestitures and asset swaps.

- Preparation for future investments in AI-powered products and data analytics.

These strategic moves emphasize that while external factors may be loaded with issues, a vigilant internal approach can create an environment primed for recovery and expansion. The management’s commitment to operational discipline is a super important element, ensuring that the company remains agile in the face of market challenges.

Future Prospects: Continued Digital Momentum and Real Estate Adjustments

Looking ahead, the next few quarters for News Corp are expected to be defined by further digital evolution and cautious optimism in the real estate segment. Management is confident that ongoing investments in high-margin digital markets, along with strategic AI partnerships, will drive additional revenue streams. This is particularly relevant in sectors such as compliance data products and analytics offerings, where the marriage of technology and media is starting to produce significant dividends.

Emerging Trends in Digital Media and Real Estate

News Corp’s leadership foresees a landscape where digital expansion is not just a temporary trend but a long-term shift in consumer behavior. The company’s focus has been on expanding its digital subscription base through new product enhancements and refined marketing strategies. In parallel, the gradual stabilization in the U.S. and Australian housing markets offers a dual catalyst that could propel both media and real estate divisions forward.

These emerging trends create a scenario rich with potential, yet not without its own set of head-scratching bits and unexpected turns. Given global economic uncertainties and the rapid pace of technological change, management’s outlook is cautiously optimistic. In essence, it’s a balanced gamble – one that weighs digital prowess against real estate market sensitivity.

Key Future Drivers for Investors

- Expansion of recurring, high-margin digital revenue streams.

- New product enhancements, including AI-powered data offerings in compliance and analysis.

- Sustained recovery trends in both U.S. and Australian property markets.

- Efficiency gains in media operations that could expand profit margins.

- Continued strategic share buybacks, reinforcing market confidence.

Collectively, these drivers suggest that as long as News Corp continues to invest in its digital platform and manages the tricky parts in its traditional sectors, the company is well-positioned to enjoy an upward trajectory despite current market challenges.

Balancing Short-Term Setbacks with Long-Term Opportunities

While the current report shines a light on areas of strength such as digital growth and a promising real estate recovery, the short-term challenges in Book Publishing and persistent economic uncertainties cannot be ignored. The company’s ability to manage these nerve-racking challenges while pressing forward with innovative strategies is a testament to a well-calibrated risk management approach.

Weighing the Scales: Digital Ventures vs. Traditional Divisions

There is a stark contrast between the buoyant performance of News Corp’s digital endeavors and the underwhelming figures emanating from its traditional publishing arm. This disparity forces investors and onlookers to figure a path that reconciles present profit markers with future growth prospects. On one hand, the management’s aggressive push into digital markets stands as a model for how legacy media companies can evolve. On the other, the uneven recovery in Book Publishing serves as a reminder of the challenges inherent in transforming age-old business models.

The following bullet points summarize the balancing act that seems to define News Corp’s current strategy:

- Digital Success: Accelerated growth in digital subscriptions and data analytics, AI-powered enhancements, and increasing engagement in digital real estate platforms are clear highlights.

- Traditional Hurdles: The Book Publishing division, affected by issues such as lower orders and unexpected distributor losses, remains a stumbling block.

- Cost and Efficiency: Operational efficiencies and capital returns through share buybacks bolster confidence, even as certain areas lag.

- Real Estate Resilience: A 9% year-on-year growth in realtor.com revenue points to the potential for recovery in an otherwise tricky market.

This balancing act demonstrates that while there are plenty of reasons to be optimistic, careful attention must be given to the little twists and subtle details that could either propel the company forward or hold it back.

Opinion: Is Now the Right Time to Buy?

In the ever-changing landscape of media and real estate, determining whether it is the right time to invest in News Corp (NWSA) is a decision laden with both promise and uncertainty. The Q3 results point to significant strides in digital growth and a cautious yet hopeful recovery in real estate. However, issues in the publishing division, along with ongoing macroeconomic uncertainties and economic headwinds, add layers of complexity to the decision-making process.

Investors who are keen to get into the market should consider the following factors carefully:

- Digital Expansion: The robust digital subscription growth at The Wall Street Journal and innovations such as AI-powered search in Factiva are likely to be super important profit drivers in the coming years.

- Real Estate Trends: A growing revenue base on platforms like realtor.com could indicate that despite a background of nerve-racking economic fluctuations, recovery is in sight.

- Publishing Challenges: The Book Publishing division currently faces significant challenges that could drag overall performance if not managed carefully.

- Cost Management and Capital Returns: Strong free cash flow and an aggressive share buyback program are positive signals for investors looking for stability and value.

Those considering investment decisions would do well to ponder these aspects. News Corp’s future, while promising on the digital front, is not without its confusing bits and challenging parts. It is an opportune moment for careful analysis and for weighing potential gains against the scares of short-term setbacks.

In Conclusion: A Balanced Outlook Amid Market Uncertainty

News Corp’s Q3 CY2025 report is a striking example of a traditional media house striving to transform itself in a world that is both full of exciting technological breakthroughs and nerve-wracking economic challenges. On the digital side, the company’s performance is marked by steady subscription growth, innovation through seemingly futuristic AI-powered tools, and a gradual but promising recovery in digital real estate services.

Conversely, the Book Publishing segment continues to wrestle with challenges that are tangled with issues such as declining orders and unexpected distributor problems. The balancing act between leveraging digital opportunities and managing traditional operational setbacks is a reflection of the intricate market dynamics that modern companies face.

From an investor’s perspective, the picture is one of cautious optimism. While the accelerated share buyback program and strong free cash flow suggest that News Corp is well-equipped to handle short-term market turbulence, the sustainability of these efforts depends largely on the company’s ability to continue innovating in its digital ventures and gradually stabilize its legacy divisions.

Looking Ahead: Key Trends to Watch

As we look into the future, several key trends deserve attention:

- Digital Subscription Growth: Will the gains in digital content delivery and subscription-based models continue to improve earnings over the long haul?

- Real Estate Market Dynamics: How will further stabilization in U.S. and Australian housing markets influence the digital real estate services segment?

- Operational Efficiencies: Can continued cost-control measures in news media and strategic capital allocations bridge the gap between digital success and publishing challenges?

- Global Economic Influences: What impact will macroeconomic uncertainties have on these burgeoning sectors, and how will management steer through market fluctuations?

These are the questions that will inform not just the strategies of media and real estate companies but also the decisions of individual investors and industry experts alike. With digital technology reshaping consumer expectations daily, management’s steady focus on innovation, cost discipline, and selective growth remains super important.

Final Thoughts: Striking the Right Balance in a Transforming Industry

In sum, News Corp’s latest quarterly performance offers a fascinating case study in modern business transformation. Its journey through the twists and turns of digital growth, alongside the challenges in traditional publishing and a recovering real estate market, situates the company at a crossroads where strategic choices made today will likely determine tomorrow’s successes.

The company’s confident moves – from accelerating digital subscription offerings and embracing advanced AI technologies to aggressively repurchasing shares and streamlining internal costs – highlight a path where past methods are being reimagined to meet the needs of today’s digitally informed consumer.

For those in the investment community, the decision to buy, hold, or sell now comes down to a cautious weighing of strengths versus vulnerabilities. While the potential in fast-growing digital streams is undeniable, the communication from management signals that not all pain points have been resolved. The ongoing hurdles in book publishing, coupled with a real estate sector that is still finding its footing, are areas that require diligent observation and agile strategy adjustments.

In this era marked by both great promise and considerable challenges, News Corp exemplifies the modern paradox of large media companies – a blend of legacy challenges and future-focused innovation. For our readers in the home improvement and home services fields, while the focus might be on tangible assets like homes and outdoor spaces, the underlying themes of digital transformation, cost efficiency, and strategic reinvestment are lessons that resonate across all industries.

How These Trends Relate to Home Improvement and Digital Transformation

Interestingly, similar themes can be observed in the home improvement and services sectors. Just as News Corp faces the challenge of balancing traditional methods with a digital-first approach, homeowners and service providers are increasingly embracing smart home technologies and digital management tools to enhance security, energy efficiency, and overall home aesthetics.

Here are a few validations of how the digital momentum in the corporate world parallels trends in home improvement:

- Adopting Smart Home Solutions: Homeowners are increasingly integrating digital subscription services for security, energy monitoring, and convenience – much like media companies shifting towards digital revenue models.

- Investing in Efficiency: Just as cost-control measures and efficiency in News Corp’s operations help boost profits, home improvement initiatives focused on energy efficiency yield long-term savings.

- Embracing Data and Analytics: In both corporate media and home services, the ability to rely on data analytics – whether for digital content optimization or for tracking home energy usage – is key to making informed decisions.

These parallels highlight that whether you are analyzing the stock performance of a media giant or planning a home remodel, the core principles of embracing technology, measuring performance carefully, and managing costs prudently remain universal.

Conclusion: A Cautiously Optimistic Future for Diversified Growth

The story of News Corp’s Q3 performance is one marked by innovation, strategic reinvestments, and a balancing act between emerging digital success and ongoing traditional sector challenges. The company’s proactive measures to harness digital subscriptions, bolster digital real estate services, and optimize cost structures are encouraging signals for the future, even as obstacles in the publishing arena remind us that every journey has its complicated pieces.

For investors, industry enthusiasts, and even professionals in sectors like home improvement and home services – which increasingly rely on advanced digital tools – News Corp’s evolution is both a lesson and an inspiration. It teaches us to steer through market uncertainties with agility, to invest in forward-thinking initiatives while keeping a keen eye on areas that may need reinvention, and to celebrate success while remaining mindful of the little twists that could change the game.

In these tense times, when global markets continue to be on edge and technological innovations reshape business landscapes daily, a balanced outlook is key. News Corp’s digital journey, punctuated by strategic risk-taking and disciplined capital returns, stands as a reminder that no sector is immune to disruptive shifts – whether in media, real estate, or even home services.

Ultimately, the decision to invest in such a dynamic yet unpredictable environment should be based on thorough research, a careful analysis of potential benefits versus inherent risks, and a readiness to adapt to market changes that are as unpredictable as they are exciting. For those willing to roll with the punches and appreciate the subtle details that define today’s economic landscape, this may indeed be an opportune moment to seize the many opportunities on offer.

As you consider your next steps – whether you’re tweaking your portfolio or planning your next home improvement project – the lessons drawn from News Corp’s Q3 performance may offer more than just financial insights. They serve as a reminder that strategic transformation, proactive innovation, and disciplined financial management are universal strategies for success in any field.

In the end, News Corp’s story is far from over. With the digital realm and real estate market continuing to evolve at a rapid pace, the coming quarters are likely to bring further innovations, challenges, and opportunities. Only time will tell if these efforts translate into sustained long-term growth. For now, the company’s journey is one of cautious optimism, marked by decisive actions and a commitment to rising above challenges—even as it navigates every twist and turn thrown its way.

As an observer in an industry that prizes home improvement and service reliability, I find it reassuring that the principles guiding corporate transformation echo those found in the day-to-day upkeep of our homes. Both realms require a blend of innovation, respect for tradition, and an unyielding commitment to efficiency. In that spirit, News Corp’s Q3 report, with all its fine points and challenging bits, represents not only a financial performance update but also a roadmap for adapting to change in an ever-shifting world.

Ultimately, whether you’re an investor, a homeowner, or a professional in home services, embracing the balance between tradition and digital innovation is the key to thriving in today’s dynamic environment. As we move forward, let’s keep our eyes open for both the bright digital prospects and the cautionary lessons from areas that need improvement. The smart path often lies in understanding and managing every subtle detail—and that, in itself, is a lesson worth remembering.

Originally Post From https://stockstory.org/us/stocks/nasdaq/nwsa/news/earnings-call/nwsa-q3-deep-dive-digital-growth-and-real-estate-recovery-balance-book-publishing-weakness

Read more about this topic at

NWSA Q3 Deep Dive: Digital Growth and Real Estate …

A Digitally-Enabled Recovery