Affordable Homeownership: A Nerve-Racking Journey in Today’s Market

In today’s housing market, the path to owning a home is full of tricky parts and overwhelming challenges. Even as the Federal Reserve makes moves to lower interest rates, many prospective buyers are finding that these adjustments do little to compensate for soaring home prices. For many families, especially those already juggling student loans, unexpected expenses, and the cost of living, the dream of homeownership now appears more intimidating than ever.

The story of homebuyer Britt Vaughan in Altadena, California, mirrors the experience of countless others across the country. When mortgage rates plunged to historical lows in 2021, many believed that it was the perfect time to dive in and secure a home. However, even as interest rates began to ease, rising home prices, along with economic headwinds, transformed the housing market into a convoluted puzzle. This article takes a closer look at the current trends, the impact of policy decisions, and the myriad challenges that homebuyers need to figure a path through today.

Understanding the Shifting Landscape of Mortgage Rates and Home Prices

Over the past few years, the housing market has witnessed dramatic changes. In 2021, many buyers were enticed by mortgage rates that dropped below 3%—a figure that promised affordability and financial relief. At that time, many hopeful families began to explore homeownership with visions of stability and growth. However, as time went on, a mix of rising home prices and sudden economic pressures reshaped the dream.

Recent decisions by the Federal Reserve, such as cutting the benchmark rate by a quarter-point, were intended to ease the burden on borrowers. Yet, the ripple effects of these cuts have been limited by another critical factor: the rapid escalation of home prices. This divergence between dropping rates and climbing prices has created a scenario where even if mortgage rates were to return to the lows seen in the early 2020s, many families still would struggle to afford a home due to the steep price tags.

Mortgage Rate Realities: The Confusing Bits of Home Purchases

Mortgage rates remain one of the most critical—and often confusing—bits of home buying. While rates fluctuate based on economic trends and central bank policies, their impact on overall affordability can be counterintuitive. For instance, even a modest rate decrease may not be enough to bridge the gap if home prices are simultaneously climbing.

Buyers often face the following challenges:

- The allure of lower rates is tempered by the reality of nearly $410,800 as the national median home price—a figure that has soared nearly $100,000 since 2019.

- The typical monthly mortgage payment has also risen, with many first-year payments increasing by 20% in just a few years.

- Rising homeowner insurance premiums and property taxes add even more pressure to already tight household budgets.

When prospective buyers try to steer through these tangled issues, they quickly find that the market’s twists and turns rarely allow for a straightforward solution. Even if a buyer were to secure a mortgage with an exceptionally low rate, the overall package—comprised of fluctuating prices, increasing living costs, and extended economic uncertainties—remains a nerve-racking ordeal.

Urban Affordability Crisis: Hidden Complexities in Major Cities

One of the most striking aspects of today’s housing market is the stark contrast in affordability between different urban areas. In major coastal and metropolitan cities, such as Los Angeles, Boston, and Seattle, the dream of homeownership is slipping away for many middle-income families. Zillow’s research has shown that in these areas, even an interest rate drop to zero would not make homeownership attainable for buyers earning the local median income.

Take Los Angeles, for example. Here, the median home price hovers near $972,837—a price point that is simply out of reach for many who earn a median income. These urban markets are especially intimidating due to their high baseline prices, which act as a barrier even when financing costs are temporarily eased.

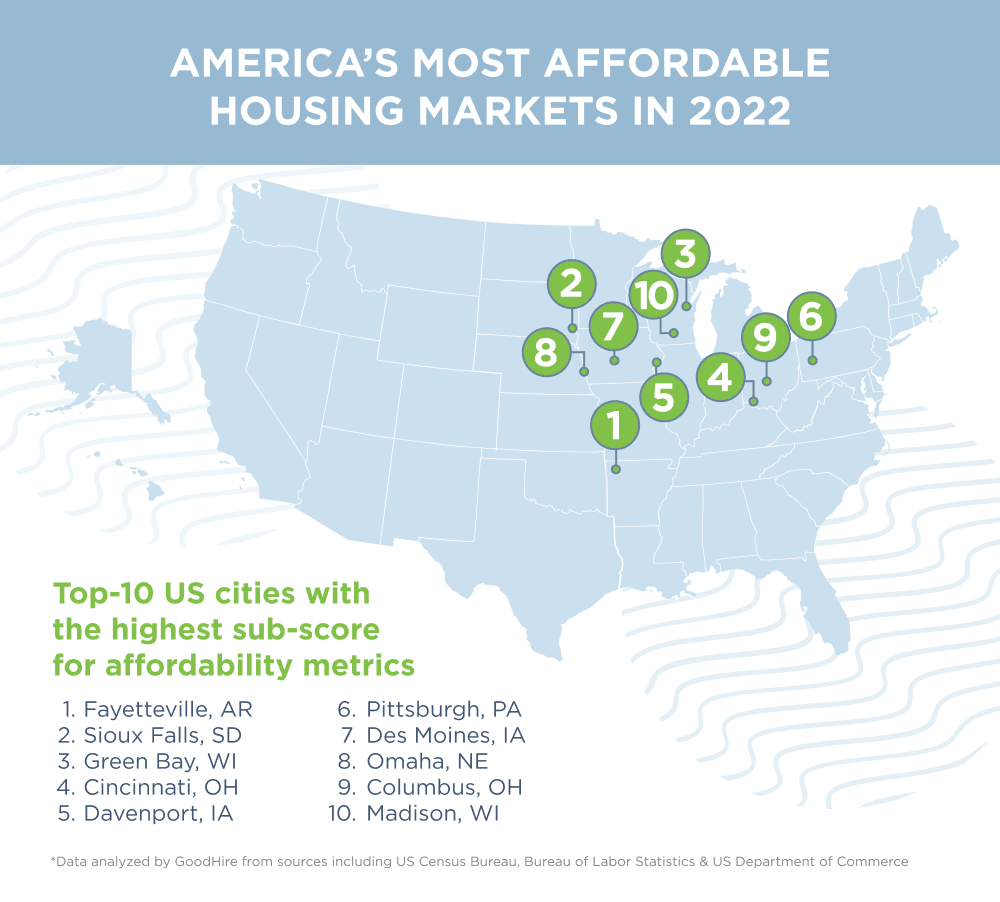

In contrast, some cities in the South and Midwest, including Louisville, Birmingham, Memphis, Chicago, Cleveland, and Detroit, still manage to offer relatively more affordable mortgage packages. However, the overall affordability of these markets is no guarantee against sudden price surges or economic shifts, keeping prospective buyers on edge.

Key Data Insights: Charting Affordability in U.S. Cities

Data from various studies highlight the real problem: home values are on an upward trajectory everywhere, even in communities where sales seem to have cooled. According to Zillow:

- In Pittsburgh, the median home price is $229,722, making it somewhat affordable relative to a local median income of $77,050.

- In major hubs like Boston, San Jose, and the D.C. area, median prices have soared to $737,436 or higher, requiring significantly higher incomes—up to $126,700 annually—to qualify for the U.S. median home price.

- Even optimistic scenarios require rates to drop below 5% to make cities like Virginia Beach, Charlotte, Philadelphia, and D.C. truly affordable, whereas places like Boston or Seattle would require even lower rates—sometimes below 1%.

Below is a simple table illustrating some of the affordability contrasts across the nation:

| City | Median Home Price | Local Median Income Requirement | Rate Needed for Affordability |

|---|---|---|---|

| Pittsburgh | $229,722 | $77,050 | Above 6% sustainable |

| Los Angeles | $972,837 | Well above local median | Rate drop insufficient |

| Boston | $737,436 | $126,700 (for national median) | Below 5%, ideally below 1% |

| San Jose | $1.6 million | Substantially high | Much lower than current rates |

This table reflects the clear trend: houses in some cities remain out of reach even for median-income earners, and the situation only worsens when one factors in rising rates and additional costs like insurance and association fees.

Rising Home Prices and Their Toll on Homebuyers and Sellers

One of the trickiest parts of today’s housing market is the simultaneous pressure on both homebuyers and home sellers. On one hand, potential buyers find themselves locked in a cycle of dreaming about a home they can barely afford. On the other, current homeowners who secured low mortgage rates years ago are now more inclined to hold onto their properties rather than trading them for homes that require higher borrowing costs.

This reluctance among sellers has a cascading effect on the market’s supply. With fewer homes available, the already steep prices continue to climb. Economic indicators suggest that even slight improvements in mortgage rates may not trigger an increase in home sales. Many owners find it nerve-racking to exchange their low-rate loans for new mortgages at higher rates, even if the benefits of selling and relocating exist.

Peeling Back the Economic Layers: Policy and Interest Rate Dynamics

The Federal Reserve’s actions have been a central talking point in recent discussions about housing affordability. With the Fed cutting interest rates marginally by a quarter-point, the anticipation was that lower rates would fuel more affordable borrowing for homebuyers. However, economic analysts caution that this is only half the picture. The true challenge lies in the rising home prices, which offset any financial relief provided by the rate cuts.

For instance:

- Economists warn that even with historically low rates, the cost of the home itself is the primary barrier to entry. The market’s current condition is a classic example where the cost increase outpaces the decrease in borrowing expenses.

- Furthermore, the pressure from federal policy, including aggressive calls from political figures to lower rates even further, does not address the underlying issues of a market that has seen two decades of underbuilding.

- If the focus remains solely on interest rate reductions without boosting the supply of new homes, the affordability crisis will linger for years to come.

Policy experts argue that a broader suite of federal policies is needed. These might include incentives for new home construction, tax benefits for sellers reinvesting in new properties, and adjusted regulations to ensure that home prices reflect more than just market speculation. Until these measures are widely implemented, many homeowners and potential buyers will continue to feel loaded with issues that complicate the seemingly straightforward process of home buying.

Middle-Income Families on Edge: The Overwhelming Reality

For many middle-income families, the housing market has transformed from a realm of opportunity into one filled with daunting, tangled issues. The subtle parts of the current challenge involve not just the mortgage rates but a host of additional costs that together create an almost insurmountable barrier:

- Monthly mortgage payments now increasingly exceed 30% of household income for many homeowners, a level that financial advisors consider unsustainable.

- Homeowner’s insurance premiums have shot up by over 50% in recent years, particularly in areas increasingly affected by climate-driven weather events.

- Property taxes have followed suit, with many homeowners finding that gains in home value translate directly into higher tax bills each year.

The cumulative effect of these costs is that the overall affordability of homeownership is rapidly diminishing. Families who once had a clear ladder to buying a home are now left questioning whether renting might be a safer, more manageable choice—at least until the housing market stabilizes.

Additional Costs of Homeownership: Insurance, Maintenance, and Beyond

Beyond just the mortgage, there are a host of additional bills that add to the many confusing bits of homeownership. Rising homeowner’s insurance premiums, for example, are a direct response to an increase in severe weather events and climate-related damages. In coastal areas especially, the cost to insure a home can be nerve-rackingly high.

Homeowners also grapple with homeowners association (HOA) fees, maintenance expenses, and the cost of keeping up with necessary renovations that protect the value of the property. For those with limited savings, these extra expenses can be the tipping point that turns a potential investment into an overwhelming financial commitment.

All of these factors combined mean that managing your way through homeownership in today’s market requires careful financial planning and a realistic appraisal of one’s income versus the total cost of owning a home. Without a measured approach, many families risk overextending themselves in an already expensive market.

Working Toward Solutions: Policy Options and Practical Advice

With homeownership slipping out of reach for a growing segment of the population, experts are calling for a range of federal policies and community-level initiatives to help balance the playing field. While lowering interest rates is one lever that policymakers can pull, it is not a silver bullet. Instead, a more nuanced set of solutions is needed.

Some practical strategies and policy suggestions include:

- Encouraging New Construction: By streamlining permitting processes and offering tax incentives to developers, local and national governments can help increase the supply of affordable homes. This move addresses one of the root causes of rising prices—years of underbuilding.

- Tax Incentives for Sellers: Policies that allow sellers to reap more benefits from the sale of their homes without facing heavy tax penalties could encourage those with low-rate mortgages to put their houses back on the market, thereby increasing inventory in competitive regions.

- Support for First-Time Buyers: Enhanced programs for first-time homebuyers, including down payment assistance and favorable loan terms, can help lower the initial financial barrier. This assistance is especially critical for families who find that everyday expenses leave little room for long-term financial commitments.

- Investment in Community Development: Local governments should consider investing in infrastructure and community-based programs that stabilize local markets, ensuring that improvements in public amenities correspond with modest increases in home prices.

Each of these recommendations addresses a different piece of the overall puzzle. Collectively, they offer a more comprehensive approach to a problem that is both off-putting and layered with many troublesome economic twists and turns.

Home Improvement and Remodeling: Preparing Your Property for the Future

While broader economic forces continue to shape affordability issues, individual homeowners and buyers are also looking for ways to add value to their properties and protect their investments. Home improvement and remodeling projects, for example, can be an excellent strategy to enhance a property’s appeal in a competitive market.

Whether you’re upgrading your kitchen, improving energy efficiency, or enhancing curb appeal, targeted renovations can help a home stand out. These projects not only boost market value but also help homeowners feel more secure about their long-term investment. When planning such projects, it’s important to keep in mind:

- Budget Considerations: Even small improvements should be planned with a clear budget in mind. Overextending on renovations can be as risky as taking on an expensive mortgage.

- Cost vs. Value: Not every update yields a high return on investment. Research shows that certain projects, like kitchen remodels or energy-efficient upgrades, often provide better long-term value than cosmetic changes.

- Local Market Trends: Understanding the tastes and needs of your local area is key. In markets where affordability is a challenge, focusing on improvements that lower ongoing costs (such as energy efficiency) can offer a dual benefit.

Home improvement projects can serve as both a practical way to manage rising property values and a means to protect the long-term value of your investment. In a market where affordability remains a pressing issue, finding creative ways to add value to your property is becoming an essential—and sometimes nerve-racking—part of homeownership.

The Road Ahead: Building and Buying in a High-Price Market

Looking forward, the housing market seems poised to remain loaded with issues if current trends persist. While the Federal Reserve’s adjustments and potential policy shifts offer some hope, the reality remains that home prices have now reached levels that are, for many, simply beyond reach.

The future of housing affordability may hinge on several factors:

- Economic Recovery and Innovation: A robust economic recovery post any downturns could inject much-needed stability into the market. Innovations in construction technology and sustainable building practices might also help reduce build times and costs.

- Policy Reform: Beyond mere rate cuts, comprehensive policy reforms aimed at incentivizing construction, easing zoning restrictions, and supporting first-time buyers could pave the way for a more balanced market.

- Market Adaptation: Sellers and buyers alike will need to become more agile in managing this challenging environment. The ability to figure a path through these tangled issues will be key to navigating a market that is concurrently dynamic and unpredictable.

Developers and investors are also keeping a close eye on these shifts. With lower mortgage rates offering some hope, even developers are cautious about committing to new projects without clear signals of sustainable demand. As a result, much of the market’s future depends on not just the immediate economic policies but on long-standing shifts in how communities are built and maintained.

Confronting the Intimidating Challenges: Finding Your Path Through Tricky Parts

For families on the hunt for a home, the current environment is undeniably intimidating. The combination of rising prices, additional costs, and high mortgage payments creates a landscape that is as nerve-racking as it is complicated. Yet, amid these challenges, there are steps that buyers can take to manage their way through:

- Financial Planning: Engage in detailed budgeting and financial assessments before making any decisions. Understanding your income, expenses, and potential for future savings can provide clarity and help you make informed choices.

- Research Local Markets: Since affordability varies widely from one region to another, take the time to poke around local housing trends. Identifying areas where home prices are more reasonable could be the key to unlocking homeownership sooner rather than later.

- Consult with Experts: Real estate professionals, financial advisors, and home improvement specialists can offer invaluable insights. Their experience in dealing with the fine points and hidden details of the market may reveal opportunities that aren’t immediately apparent.

- Long-Term Thinking: Real estate is often a long-term investment. Focusing on sustainable homeownership rather than short-term gains might reduce the pressure to buy in a market that feels overwhelmingly expensive.

Each potential homebuyer should view the current housing crisis as a sign of the times—a call to adapt and rethink what it means to own a home. It is a signal that both individual financial planning and broader economic reforms must come together to address the tangled issues of affordability.

Community Initiatives and the Role of Local Governments

While national policy plays a critical role, local governments and community organizations also have much to offer. Community-driven initiatives to support affordable housing have surged in recent years, often filling gaps left by national policies. Local governments can help by:

- Establishing programs that offer down payment assistance to first-time buyers.

- Investing in mixed-use developments that combine affordable housing with essential amenities.

- Partnering with private developers to build new housing units at competitive prices.

- Creating community roles where experienced homeowners guide new buyers through the maze of financing, renovations, and neighborhood dynamics.

These initiatives not only have the potential to ease the financial burden on individual buyers but also can lead to more vibrant and resilient communities. When local governments and residents work together, the challenges of the high-price market can become more manageable, even if the overall economic landscape remains tense.

Balancing Home Improvement with Broader Market Concerns

Homeowners looking to renovate or upgrade their properties face another set of twists and turns. Remodeling projects, while offering a way to increase property value, also come with their own set of challenges:

- Material Costs: The cost of construction and renovation materials has risen alongside home prices, making even modest improvements a significant investment.

- Labor Shortages: Skilled labor is in high demand, often resulting in delays and higher wages, which further inflate the cost of improvement projects.

- Energy Efficiency Upgrades: While essential for long-term savings, improvements related to energy efficiency require upfront investment that many homeowners find daunting.

- Planning and Permits: Local regulations can complicate the process significantly. Homeowners need to take extra time to figure a path through bureaucratic hoops.

Home improvement is not just a means of keeping up with neighbors—it is a critical strategy for increasing comfort, safety, and ultimately, a home’s market value. However, when the market pressures are as overwhelming as they are today, every renovation decision must be made cautiously, weighing both immediate costs and long-term benefits.

Final Thoughts: Carving Out a Sustainable Future in an Expensive Market

In wrapping up, the challenges of affordable homeownership are more nerve-racking and complicated than ever before. The sluggish pace of rate cuts combined with rapidly rising home prices has reshaped how families approach one of life’s most significant investments. The current market is riddled with issues—from conflicting economic signals to hidden costs that extend far beyond the mortgage payment—and each of these factors demands careful consideration.

Yet, amidst all the uncertainty, there are reasons for cautious optimism. With thoughtful policies, community initiatives, and a renewed focus on balanced development, there is hope that the tide can turn. For prospective buyers, it is essential to remain informed, engage with experts, and be prepared to make bold yet calculated decisions.

The journey toward homeownership today might be filled with intimidating, tangled issues, but it is also a chance to redefine what it means to invest in a place you can call home. As we continue to adapt to these high-price, high-pressure market conditions, every family has the opportunity to learn, adjust, and eventually find a way to secure not just a house, but a stable, lasting home.

Conclusion: Taking the Wheel in a Challenging Housing Market

In conclusion, the current landscape of homeownership is loaded with challenges that extend far beyond simple interest rate adjustments. Rising home prices, additional costs like insurance and property taxes, and the lingering effects of years of underbuilding have created a market where even traditionally safe investments come with nerve-racking twists and turns.

Whether you are a prospective buyer trying to figure a path through tangled financial issues or a current homeowner contemplating the value of renovations and market timing, the key is to stay informed and proactive. By being mindful of every little detail—from budgeting to policy changes—you can find your way through this complicated market and one day claim a space that truly feels like home.

Even as national and local policies evolve, the importance of personal financial planning and community support remains super important. With the right blend of government initiatives and individual action, there is a path forward—a path that, while off-putting at times, offers the promise of future stability in an otherwise intimidating market.

Now more than ever, homebuyers, homeowners, and community leaders must come together to address these hidden complexities. As we take the wheel and work through each challenge with careful planning and a clear mind, there is hope that future generations will find a housing market that is not only accessible but also welcoming.

Originally Post From https://www.washingtonpost.com/business/2025/09/18/mortgage-rates-fed-zillow/

Read more about this topic at

The Problem

A Shortage of Affordable Housing