Fed Rate Cut: Unraveling Its Impact on Home Financing and the Housing Market

The recent Federal Reserve rate cut has sparked lively debate among homeowners, homebuyers, and mortgage experts. While headlines trumpet potential benefits for mortgage rates, the actual picture is filled with tricky parts and confusing bits. In this opinion editorial, we take a closer look at the Fed’s latest move, explore how mortgage rates are determined, and examine the impacts on home buying and refinancing. We’ll dive into key factors—bond yields, economic forecasts, and housing market trends—to better understand this hot topic.

In the coming sections, we’ll work through the various elements that shape mortgage pricing, provide insight into the Fed’s perspective on economic stability and employment, and discuss what this means for everyday homeowners. As you read on, you’ll find that while interest rate cuts can create opportunities, there are also tangled issues that buyers need to consider before making a move.

How the Fed’s Rate Cut Influences Mortgage Rates

The Federal Reserve’s decision to reduce its benchmark rate by a quarter-point was anticipated by many, and it has led to a modest dip in mortgage rates, notably on the 30-year home loan. However, the connection between this action and the rates offered to mortgage borrowers is not a straightforward highway without twists and turns.

Understanding the Relationship Between the Fed’s Policy and Home Loan Rates

Although the Fed’s main interest rate has long been considered a benchmark for overall economic health, it does not directly set mortgage rates. Instead, several factors contribute to home loan pricing. The mortgage rate is influenced by:

- Expectations around economic growth

- Investor sentiment in the bond market

- The yield on the 10-year U.S. Treasury note

- Inflation trends

Mortgage rates tend to follow the movement of the 10-year Treasury yield because mortgages are often bundled into mortgage-backed securities. If bond yields drop, lenders can offer comparatively lower rates, and vice versa. This chain reaction underscores why a Fed rate cut can eventually lead to lower rates for some borrowers—but not necessarily in a simple or immediate fashion.

Recent Trends in Mortgage Rates

Since late July, mortgage rates have been on a general decline. For example, the average rate on a 30-year fixed mortgage recently dipped to 6.35%, which is the lowest in nearly a year. Historical context provides insight: a similar drop in mortgage rates before the Fed’s previous rate cut led to temporarily lower rates, only to see them rise again in subsequent months. This pattern highlights that while the current environment might seem promising, the journey ahead is still loaded with issues and potential reversals.

Experts point out that despite expectations for potential additional rate cuts, there is never a guarantee that mortgage rates will continuously decrease. There remain several factors—such as inflation spikes or shifts in investor sentiment—that might reverse the downward trend. As Lisa Sturtevant, chief economist at Bright MLS, explains, “Rates could come down further, but the potential exists for them to reverse if inflation unexpectedly heats up.”

Key Economic Factors at Play

Understanding the broader economic picture can help homebuyers figure a path through the twists and turns of mortgage rate changes. It is essential to look at the interplay between job market conditions, inflation, and bond market behavior.

The Tug of War Between Inflation and Employment

One major reason behind the Fed’s rate cut is concern over the weakening job market. A softer labor market can warrant lower interest rates to inject energy into the economy. However, there remains a balancing act. On the one hand, cutting rates can stimulate hiring and spending, which is super important for a growing economy; on the other, too many rate cuts might risk fuelling inflation, which puts upward pressure on mortgage rates.

Inflation remains just above the Fed’s target of 2%, meaning that even with a recent rate cut, home buyers and mortgage lenders must remain cautious. Danielle Hale, chief economist at Realtor.com, recently noted that the real challenge is not only the Fed’s moves today but also what people expect in the near future regarding economic growth, the job market, and inflation. These expectations shape mortgage rate trajectories on a week-to-week basis.

Bond Yields and the Uncertain Road Ahead

Mortgage rates generally mirror the performance of the 10-year Treasury bond, which can be influenced by economic forecasts and investor behavior. When the job market seems unstable, investor demand for these safe-haven bonds increases, driving down yields and potentially lowering mortgage rates. Conversely, if inflation fears take center stage, yields can rise, increasing the cost of home loans.

Below is a simplified table that illustrates the relationship between Treasury yields and mortgage rates:

| Factor | Effect on Treasury Yield | Likely Mortgage Rate Movement |

|---|---|---|

| Weaker Job Market | Yields fall | Mortgage rates may decline |

| Higher Inflation | Yields rise | Mortgage rates may increase |

| Positive Economic Growth | Yields may stabilize or increase moderately | Minor upward pressure on mortgage rates |

This table shows the necessity of juggling several economic signals. As mortgage rates and Treasury yields are closely linked, any sudden change in one part of the market can produce a cascade effect through the entire system.

What Homeowners and Buyers Should Expect

Despite the hopeful headlines that come with a rate cut, the prospect of lower mortgage rates is not as clear-cut as it might seem. Homebuyers, sellers, and those considering refinancing must remain vigilant and cautious. The housing market is still full of problematic aspects, including persistently high home prices and the potential for increased competition among buyers.

Timing the Market: A Risky Strategy

For many potential buyers, the decision of whether to purchase now or wait for further rate decreases is nerve-racking. Trying to time the market perfectly is an overwhelming challenge due to the many variables at play. Some mortgage specialists advise that borrowers who can afford current rates might be better off purchasing a home now rather than risk missing out on a property that fits their needs later.

Below are some key points to consider when deciding whether to buy now:

- If you find a home that meets your needs and budget, it may be wise to purchase now rather than waiting for rates that may never materialize.

- If you’re looking at refinancing, aim for a drop of at least one percentage point in your current mortgage rate to offset the refinancing costs.

- The potential for increased competition might make lower rates a double-edged sword if more buyers flood the market.

Stephen Kates, a financial analyst at Bankrate, summarizes the advisory: “If the Fed’s rate cuts continue, they might bring some relief, but that doesn’t guarantee that mortgage rates will fall dramatically. The market remains full of confusing bits, which means home buyers have to be prepared for potential shifts on either side.”

Refinancing in the Current Environment

The decline in mortgage rates has been a boon for homeowners looking to refinance. Many have taken advantage of the situation to lower their rate exposure and improve their monthly budgets. With refinancing applications increasing, borrowers are simply trying to find their way through a matrix of complicated pieces that include application fees, closing costs, and potential changes in loan terms.

Here are some steps to follow if you’re considering refinancing:

- Compare offers from multiple lenders to find the best deal.

- Ensure that the reduction in interest rate is sufficient—generally by at least one percentage point—to justify the refinancing expenses.

- Review your credit score and financial status, as these factors can affect your refinancing terms.

When evaluating your options, it may help to use online calculators to get a clearer picture of your potential savings. Ultimately, refinancing should be a thoughtful process that weighs the benefits of a lower rate against the upfront costs involved.

Longer-Term Predictions for the Housing Market

The Fed’s projections signal that further rate cuts may be on the horizon—but the market has not yet shown certainty. The future financial landscape is loaded with issues, and while some believe that mortgage rates might continue their downward trend, others warn of a possible rebound.

Expert Forecasts and Market Sentiment

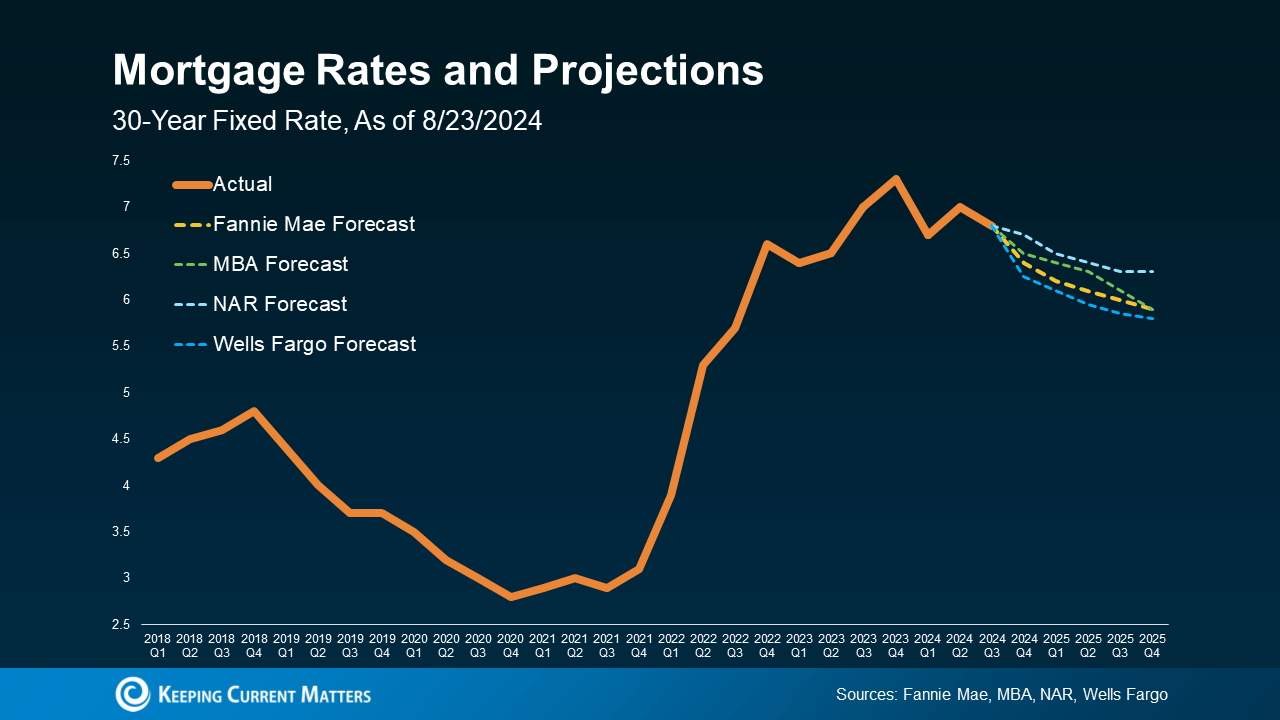

Various experts have put forward cautious predictions regarding mortgage rates. For instance, Danielle Hale from Realtor.com has forecast that the average rate on a 30-year mortgage could settle between 6.3% and 6.4% by year-end. This outlook is shared by many in the field, suggesting that even with additional rate cuts, we may not see mortgage rates plummet below 6% in the near term.

Below are several key economic signals worth keeping an eye on in the current climate:

- Inflation Data: Any significant uptick in inflation could spark a reverse in the downward trend of mortgage rates.

- Labor Market Reports: Job data is critical because a weaker labor market could sustain or encourage further rate cuts.

- Treasury Yields: These yields will continue to serve as a barometer for mortgage rate movements.

Investors and homebuyers alike are closely monitoring these elements. Such indicators not only help forecast mortgage trends but also shed light on broader economic conditions that affect everyday financial decisions.

Homebuyers’ and Sellers’ Strategies in a Changing Market

The housing market remains a mixed bag. While lower mortgage rates increase buyer purchasing power, high home prices continue to keep the dream of home ownership out of reach for many. Sellers, on the other hand, must contend with a market where serious buyers are cautious due to mortgage uncertainties.

Tips for Homebuyers in an Uncertain Mortgage Landscape

For those in the market for buying a home, figuring a path through these twisted market cues requires balanced judgment. Here are several key strategies that can help homebuyers take advantage of the current conditions:

- Act Promptly on Good Opportunities: While the possibility of a further rate drop is enticing, don’t let the search drag on indefinitely, risking missed opportunities.

- Get Pre-Approved for a Mortgage: This step not only clarifies your budget but also positions you more competitively with sellers in a market that may become more competitive if more buyers enter the fray.

- Consider the Total Cost: Remember that interest rates are just one part of the overall expense. Also account for home prices, taxes, and maintenance costs.

- Keep an Eye on Economic Updates: Stay informed about inflation trends, job market changes, and Treasury yields to better understand when to strike at the best time.

By staying well-informed and working with experienced professionals, homebuyers can better manage their way through this environment of small distinctions and confusing bits. Even if the market remains handcuffed by high prices, flexible financing options and proactive planning can make a significant difference.

Advice for Home Sellers in a Competitive Market

For homeowners looking to sell, today’s market requires a thoughtful approach as well. Sellers need to strike a balance between pricing their property competitively and maximizing their return without being driven off by buyers who may be hesitant due to high mortgage costs.

Here are some suggestions for potential sellers:

- Price Competitively: Consider current market dynamics and price your property to attract a wide range of potential buyers.

- Highlight Value-Added Features: In a competitive environment, emphasizing recent upgrades or energy-efficient features can set your home apart.

- Work with a Trusted Real Estate Agent: An experienced agent can help you sort out the fine points of local market trends and ensure effective marketing strategies.

- Be Prepared for Negotiations: With more buyers in the market due to lower rates, expect that negotiations might become more intense and require flexibility on your part.

Whether buying or selling, both parties must weigh the advantages of today’s lower rates against the backdrop of high home prices and shifting market conditions. It is essential to work with knowledgeable professionals who can help figure a path through these complicated pieces and ensure smooth transactions.

Potential Pitfalls and Risks to Look Out For

No market is without its risks, and the current housing scene is no exception. Although a rate cut can seem like a silver lining, the journey ahead is loaded with potential challenges that both homebuyers and homeowners need to be mindful of.

Inflation and Its Side Effects

A primary concern is the risk of rising inflation. Even though the Fed has taken steps to support the labor market through rate cuts, if inflation begins to spike unexpectedly, lenders might compensate by raising mortgage rates. This would make home financing more expensive at a time when affordability is already a critical issue for many.

Some of the potential pitfalls include:

- Unexpected Inflation: If consumer prices rise more than anticipated, the prolonged increase in home financing costs could reverse the temporary relief provided by rate cuts.

- Short-Term Volatility: Market reactions to new economic data can cause mortgage rates to fluctuate, making it challenging for buyers to determine the best time to lock in a rate.

- Economic Uncertainty: A range of economic factors—from global trade issues to geopolitical tensions—continues to shape the broader financial landscape. The resulting unpredictability means that even carefully laid-out plans might require adjustments as conditions change.

Keeping a diverse set of scenarios in mind can help prospective buyers remain flexible. Engage with financial professionals who can help craft a strategy that is robust enough to handle these little twists and turns.

Potential Effects on Housing Affordability

Despite the gradual easing of mortgage rates, home affordability remains a significant concern. Home prices have risen steeply over the past decade, and while the rate cuts might help buyers manage monthly payments, they do not address the overall high cost of homes.

Key factors to consider include:

- Home Price Appreciation: Even with slightly lower interest rates, rising home prices may force many prospective buyers to delay entering the market.

- Income Disparities: For first-time buyers or those with lower incomes, the persistent gap between income levels and housing costs continues to be a major obstacle.

- Regional Differences: The impact of mortgage rate changes often varies geographically. Markets that have experienced dramatic price increases may not see substantial changes in affordability, even if borrowing costs dip.

Homebuyers must weigh the benefits of attractive financing against these broader market challenges. In many cases, additional measures—such as local government incentives or alternative financing models—may be necessary to truly bridge the affordability gap.

Looking Ahead: A Balanced Perspective

Overall, while the Fed’s quarter-point rate cut is welcome news and offers some hope of easing financing conditions, it is not a magic bullet for the housing market. The coming months are likely to present salty challenges alongside any potential benefits, and those looking to buy or refinance will need to prepare for both best-case and worst-case scenarios.

The Mixed Impact on the Housing Market

For home buyers, a period of lower mortgage rates can translate into improved purchasing power. Yet the journey is still loaded with issues—from stiff competition due to an influx of buyers to persistent high home prices that continue to hinder many would-be homeowners. Sellers, too, are grappling with a market that demands flexibility in pricing and negotiation strategies.

Here’s a bulleted summary of what to expect in the near term:

- Potential for Further Rate Cuts: The Fed has hinted at up to two more rate cuts, though the market currently projects a less aggressive path.

- Continued Volatility: Economic data releases and shifting investor sentiment will likely keep mortgage rates subject to short-term fluctuations.

- Increased Competition for Homes: As lower rates attract more buyers, those searching for homes might find themselves in bidding wars.

- Refinancing Opportunities: Homeowners can benefit from refinancing, provided that the savings outweigh the setup costs.

Embracing a Realistic Outlook

In our ever-changing economic landscape, it is critical for every stakeholder—whether a homebuyer, seller, or current homeowner—to remain alert to subtle details, small distinctions, and unexpected developments. While the Fed’s decision provides a hopeful sparkle against the backdrop of a complex market, looking further ahead means balancing optimism with pragmatic caution.

It is essential to remember that while lower rates improve monthly budgets, they do not solve the underlying issues of housing supply and affordability. As economic conditions evolve, so too must our strategies for managing our home finances and real estate investments.

Conclusion: Charting a Course Through Confusing Bits and Challenging Turns

The recent Fed rate cut has added another layer to an already nerve-racking financial landscape. For those trying to figure a path through the maze of fluctuating mortgage rates, rising home prices, and shifting economic indicators, the journey remains as challenging as it is potentially rewarding.

This opinion editorial offers a balanced perspective on how rate cuts can provide temporary relief to the housing market—but also reminds us that the benefits are neither immediate nor uniformly distributed. Homebuyers should take advantage of favorable conditions when possible, while sellers must be prepared to adapt to an evolving and competitive market.

In summary, here are some final takeaways:

- Stay Informed: Regular updates on inflation, the job market, and Treasury yield movements are key to making sound decisions.

- Act with Caution: Use professional advice to steer through the many confusing bits and hidden complexities of the mortgage market.

- Plan for the Long Haul: Both buying and selling require a strategy that balances immediate opportunities with the long-term realities of economic trends.

- Keep Your Options Open: Whether it’s refinancing or locking in a purchase, maintain financial flexibility to adapt as the market shifts.

Ultimately, the Fed’s move is just one twist in an intricate dance between policy, market forces, and individual financial decisions. For homeowners and prospective buyers, the challenge lies in discerning which signals to heed and which to watch from a safe distance.

By learning to navigate these tricky parts and adjusting expectations when needed, all parties involved can make informed choices that align with their personal and financial goals. As we continue to watch the interplay of policy actions and market reactions, one thing remains clear: the home financing landscape will always present a mix of relief and risk, optimism and uncertainty.

In the end, whether you’re on the path to buying your dream home, looking to refinance your existing property, or selling your home in a competitive market, understanding the little twists and subtle details of today’s housing market is super important. It will help you manage your way through the complex pieces of this ever-evolving financial landscape—with a balanced view that embraces both the opportunities and the challenges that lie ahead.

Originally Post From https://fortune.com/2025/09/19/what-does-the-fed-rate-cut-mean-mortgages-housing-real-estate/

Read more about this topic at

Forecast & Outlook

The Outlook for the U.S. Housing Market in 2025